Further costs were also incurred in shifting businesses from being GST to SST compliant. Businesses need to understand the GST bill for their benefit and provide valuable feedback to the government.

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

It is how it will be utilised.

. It would appear that the GST can be a good thing for the country in the long run but it isnt just the collection of more tax that has many Malaysians concerned. We can probably expect the same thing to happen to Malaysia over a period. SMEs contributed 363 per cent to Malaysias.

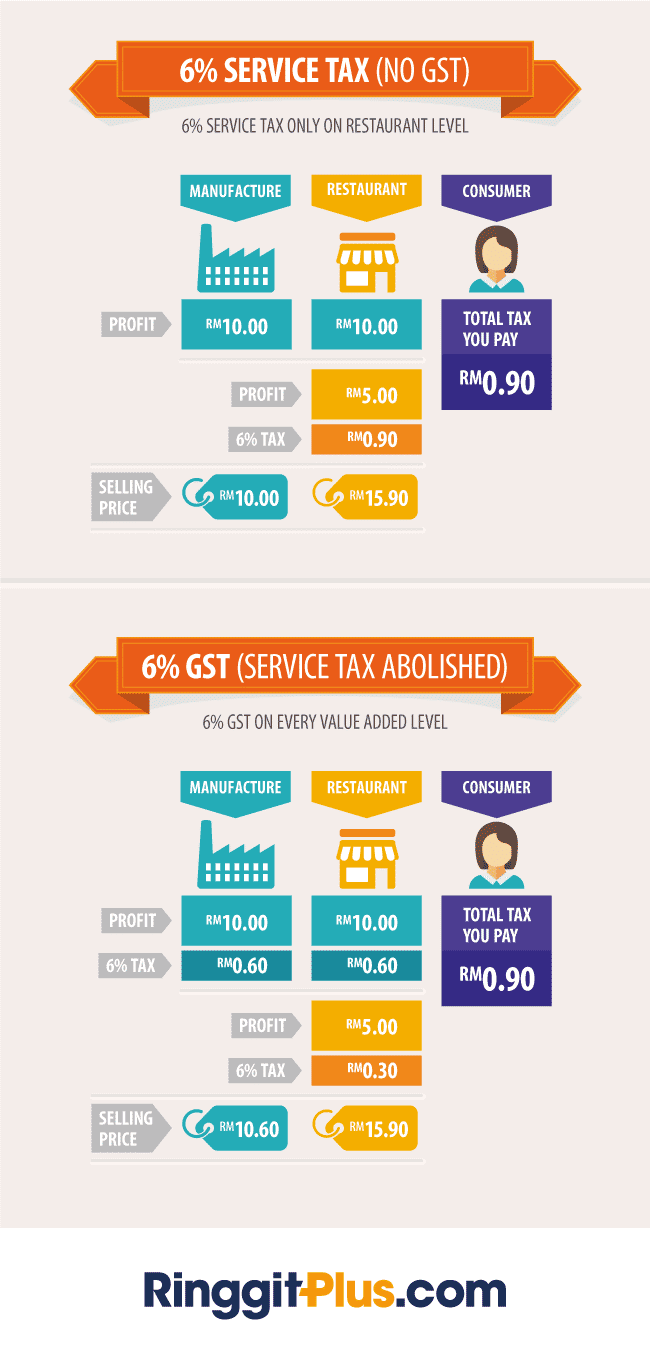

The existing standard rate for GST effective from 1 April 2015 is 6. GST will not be imposed on piped water and first 200 units of electricity per month for domestic. Based on the Malaysian GST model the price effects are minimal due to.

A major concern about the implementation of the GST is the resulting price effects on consumers. A study on the incidence of GST in Indonesia by Kusumanto⁶ found that there were not many changes in relative prices when GST was implemented. The Goods and Services Tax GST has been in effect for a while now in Malaysia.

These include the cost of software tax recording tools and professional advice. The government recently announced the GST rate of 6 will be reduced to zero percent starting from June 1 2018. Of the 33 of Malaysians who spend less now 27 state they do so because of GST and 18 because of the uncertain economy.

Production cost is lower because GST paid on input is claimable by businesses. Basic and essential foodstuff will be zero rated. Goods and Services Tax GST Malaysia will be implemented with effective from 1 April 2015 and GST rate is fixed at 6 per cent.

The Goods and Services Tax is an abolished value-added tax in Malaysia. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. The purpose of the GST is mean to create a single overall taxation system in the entire country for all the goods and.

Sales tax and service tax will be abolished. The government has proposed to introduce a Goods Services Tax of 4 GST in 2011. This may have an adverse impact since GST incurred for the making of zero-rated supplies is.

GST registration in Malaysia is not the only process which was made online. With GST implementation revenue collection increased by about 3 per cent to 2197 billion Malaysian Ringgit MYR and reduced the fiscal deficit to 3 per cent of GDP in 2017. It increased the consumption of food.

Great Impact on the Real Estate. The 28 of Malaysians who spend more now state they do so because of the price increase caused by GST 50 and the price increase because of the Ringgit devaluation 31. Empirical estimation is based on the generalised autoregressive conditional heteroscedasticity 1 1 model for pre- and post-announcement of the GSTResult shows that volatility of Malaysian stock market index increases in the post-announcement than in the pre-announcement of the GST which indicates that educative programs employed by the government before the GST.

The GST is basically a form of taxation system imposed by the government where there is a single tax in the economy that is placed upon goods and services offered. Since the introduction of GST Singapore had revised its GST rate from 3 to 4 to 5 and subsequently to the present 7. The promise to abolish GST was a powerful card played successfully by then opposition Pakatan Harapan to wrest power from Barisan Nasional.

Even the payment of the GST tax has been made online which makes it unfamiliar for the small businesses to comply unlike the old days wherein the process of tax filing was done offline. Our study investigates how the introduction of the GST affected small and medium-sized enterprise SME owners in the retail sector. THE argument that the Goods and Services Tax GST was a major factor in price increases found receptive ears among Malaysians.

Malaysia An Ipsos Observer AsiaBus study conducted among a 1002 Malaysians across states and demographics in peninsular Malaysia to measure pre and post GST spending found that over 61 of Malaysians have been impacted in their shopping. Over half of Malaysians have been impacted by GST when it comes to their shopping behaviour. In the case of GST we can speculate a thing or two by looking at Singapore which began implementing GST in 1994.

The Malaysia proposed GST bill has been recently released in December 2009 and it will have an impact on businesses and people. Public amenities will be exempted. The GST contributed MYR412 billion in 2016 compared to a predicted figure of MYR18 billion from the sales tax and services tax.

5 In addition the. Many domestically consumed items such as fresh. Also it would be reasonable to expect that the impact of GST on prices in Malaysia may mirror more closely that of Indonesias experience since it is also a developing country.

In general there are 3 notable impacts the public and businesses will feel from the change of GST. It has been reported that businesses in Malaysia have spent almost RM15 billion to implement GST systems that have been in use for less than four years8. Currently Sales tax and service tax rates are 10 and 6 respectively.

GST added 8 to the then rate of new houses. The Malaysia GST treatment may be considered simpler to implement for financial institutions but may be more costly to non-registered business and consumers in terms of the additional 6 GST they have to bear taking effect from April 1 2015.

Gst And How It Affects The Luxury Goods Industry In Malaysia Bagaddicts Anonymous

Degree Certificate That Cost Almost Rm50 000 From Sheffield Truly Proud Of It As I Use It To Degree Certificate Fake High School Diploma University Diploma

An Introduction To Malaysian Gst Asean Business News

Share And Stock Market Tips Gst To Roll Out From 1 July Firms Get Extra Time Goods And Service Tax Goods And Services Payroll Software

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Implementation Of Goods And Service Tax Gst In Malaysia Yyc Goods And Services Goods And Service Tax Malaysia

Gst Better Than Sst Say Experts

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

G Shock Gst S100d 1a4 G Shock Watches Casio G Shock Casio Watch

Gst Global Perspective Goods And Services Tax In Brazil Brazil Was The First Country To Adopt Gst System Brazil Goods And Service Tax Japan Finland

Pdf The Impact Of Goods And Services Tax Gst In Malaysia

Gst Reintroduction Could Raise Car Prices In Malaysia By 1 3 According To Aminvestment Bank Analyst Paultan Org

Sales And Service Tax Training In Ipoh Hrdf Claimable Vanue Aks Training Centre Ipoh Date 16 08 2018 Time 9 Training Center Ipoh Goods And Services

1 Gst Charge At Each Level Of Supply Chain Source Royal Malaysian Download Scientific Diagram

Ground Beef Demystified Beef Ground Beef Animal Agriculture